Eldorado Gold Corp (EGO) is a Vancouver-based gold exploration and producing company that owns and operates gold mines in Turkey, Greece and Canada. The company has developed and operated assets from several merged companies and operates five mines, including the highest producing Kişladağ gold mine in Turkey, the Efemçukuru mine in Turkey, the Lamaque mine in Quebec, Canada, the Olympias mine in Greece and the Stratoni mine in Greece. EGO is listed on TSX and NYSE.

Eldorado Gold Corp (EGO) is a Vancouver-based gold exploration and producing company that owns and operates gold mines in Turkey, Greece and Canada. The company has developed and operated assets from several merged companies and operates five mines, including the highest producing Kişladağ gold mine in Turkey, the Efemçukuru mine in Turkey, the Lamaque mine in Quebec, Canada, the Olympias mine in Greece and the Stratoni mine in Greece. EGO is listed on TSX and NYSE.

Eldorado Gold Corp (EGO) is a Vancouver-based gold exploration and producing company that owns and operates gold mines in Turkey, Greece and Canada. The company has developed and operated assets from several merged companies and operates five mines, including the highest producing Kişladağ gold mine in Turkey, the Efemçukuru mine in Turkey, the Lamaque mine in Quebec, Canada, the Olympias mine in Greece and the Stratoni mine in Greece. EGO is listed on TSX and NYSE.

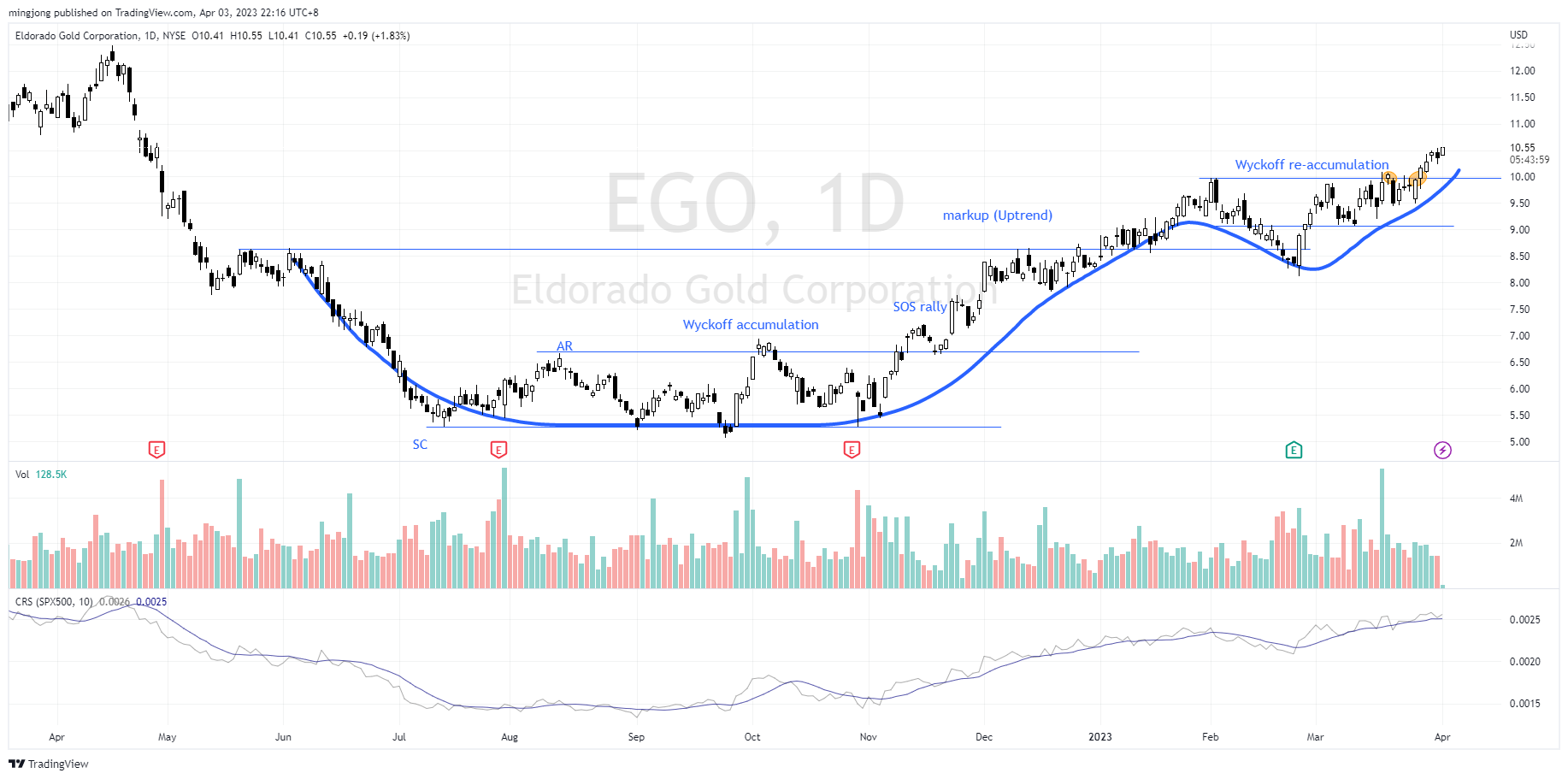

Wyckoff Spring Followed By Sign Of Strength (SOS) Rally

EGO started 2022 with a Wyckoff sign of strength (SOS) rally that peaked at $12.50 on 18 April. However, the price did not follow through to the upside and instead began to show signs of weakness. The price structure turned into the Wyckoff distribution phase until mid July. A Wyckoff selling climax (SC) occurred on 14 July after hitting the low of $5.27 and this was confirmed by an automatic rally (AR) up. This led to formation of a new trading range between $5.27 y $6.67 over next few months. There were tests to the lower range as well as Wyckoff upthrust (UT).

The range continued on until early November with a localized spring-like action. The price subsequently did a SOS rally and was able to break above $6.67 resistance on 10 Nov. It was the best rally thus far. More importantly, the reaction from this break out was a shallow pull back to retest the $6.67 level with low volume. This rally has the characteristics of a Wyckoff change of character (CHoC) where the accumulation phase was shifted to an uptrend. The price was able to continue with another SOS rally to test the $8.65 resistance.

EGO broke above the $8.65 resistance successfully on 4 Jan 2023 was able to stay committed above this level for a few weeks. Next EGO retested the $8.76 level in Feb followed by a rally and consolidation with contraction of volatility suggesting bullish bias.

The spike of volume on 17 Mar did not result in significant pull back. According to the Wyckoff effort versus result theory, this was the sign of absorption, which acted as a prompt bar to test the supply. Subsequently, the price consolidated between $9.50 y $10 until a successful breakout on 28 Mar.

Bias

Bullish. According to the Wyckoff method, EGO just broke out of a trading range between $9.50 y $10. There is no threatening volume to suggest the presence of supply. The price might retest the $10 axis, consolidate a little before attempting to challenge the next immediate resistance at $12.50. The tailwind from Gold futures could help to push EGO with more upside ahead as tweeted below.

———Ming Jong Tey【Independent Analyst】

Post a Comment

Debes ser logged in to post a comment.